Content

They may also oversee accounts payable and receivable, process payroll, and track financial transactions. Herzing University’s diploma programs exist to help you build the foundation for a long career beyond your very first job. Our diploma programs are designed to help you begin and grow your new career. You can potentially earn even greater savings by transferring credit from prior college coursework, applying for financial aid, or potential partnership opportunities through your employer. The course includes a complete overview of how to use Tally software for financial reporting, with insights into a range of business situations.

Bookkeeping is a critical function for any business or organization because financial health should inform every decision. However, not all bookkeepers have the necessary skill set to interpret data in ways that help businesses drive peak performance. That’s where earning a bookkeeping certification can make a big difference.

Bookkeeping & Payroll Accounting Online Diploma Program

Graduates can possibly earn about $17 an hour and work in any industry. Develop an understanding of the fundamentals of everyday math – the kind used most frequently in the workplace and at home. Learn practical applications for dealing with percentages, formulas, and the graphics and statistics that are present in everyday activity. AccountingCoach also has a useful search bar to look for specific topics. With an OpenLearn profile, you can easily track progress, take quizzes, and earn a statement of participation or a badge of completion.

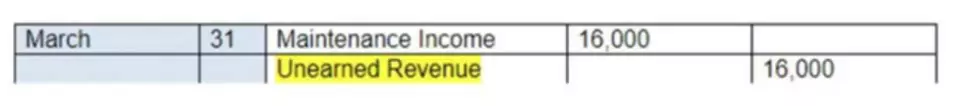

A Bookkeeper is in charge of keeping a record transactions that your business conducts. This includes recording all of your business expenses (debits) and your bookkeeping and payroll services income (credits) to report the business’s financial profits. An Accountant will use financial documents to analyze trends and report on their projected trends.

NACPB Certified Bookkeeper (NACPB)

At their core, bookkeepers produce financial records for organizations. It’s a profession that requires meticulous records and extreme attention to detail—because accuracy matters. For example, accurate records are essential for tax preparation and assessment of the performance of a business. In addition, business owners and organizations https://www.bookstime.com/nonprofit-organizations depend upon accurate bookkeeping as a basis for their decision-making. It’s a sizable list where candidates benefit from investing in courses that show a commitment to the profession. For example, bookkeepers should know how to work with existing and emerging software including Microsoft Excel, Payroll and Quickbooks.